REGISTER AND PROTECT A TRADEMARK IN BRAZIL

7 de December de 2021

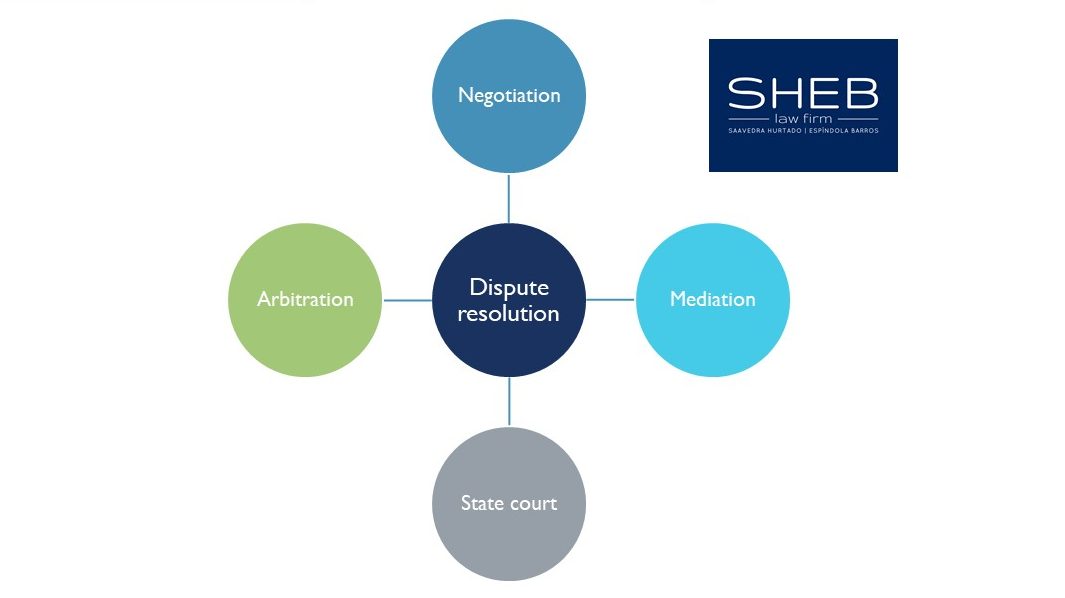

DISPUTE RESOLUTION IN BRAZIL: NEGOTIATION, MEDIATION, STATE COURTS AND ARBITRATION

1 de January de 2022Avoiding common problems in the incorporation of a company in Brazil requires both planning and local knowledge. We can offer you competent advice for dealing with Brazilian authorities to reduce the risks in the investment.

1) Main requirements regarding partners/shareholders and directors of Brazilian Companies

Brazilian Corporate Law requires that international investors (individual person or legal entity without residence/headquarters in Brazil) nominates an attorney in Brazil (a natural person with residence in Brazil) in order to receive judicial summons/notifications and represent the international investor in specific matters before the Brazilian Federal Revenue. Further, any director of a Brazilian Company must be an individual person and have residence in Brazil; (s)he might be Brazilian or a foreign citizen; in case of the latter, the person must have an unlimited resident permit for Brazil.

2) Choosing the company type

International investors that aim to incorporate a company in Brazil should incorporate a subsidiary and not a branch of a foreign company. There is a practical reason for this: setting up a branch of a foreign company in Brazil requires prior authorization by both the Brazilian government and parliament. This requirement makes setting up a branch impractical and thus it is not recommended for the majority of investors intending to set up business in Brazil. The practical solution is to incorporate a Brazilian company (or Brazilian subsidiary under international control).

Although Brazilian Law enables the setting up of a company in many forms, more than 90% of Brazilian companies are set up as “Limitada” or “Ltda.”, corresponding to a limited liability company. This is the simplest and fastest wayof incorporating a company in Brazil. A “Ltda.” company has no requirement for minimum corporate capital (although excessively low corporate capital is not recommended for practical reasons) and can be incorporated by a sole individual or company or multiple partners

Another option is incorporating a “Sociedade por Ações” or “S.A.”, which corresponds to a joint-stock company. This is suitable for companies of major structure, as its incorporation and operation is more regulated by Brazilian Law. Other types of companies are unusual, as Brazilian Law determinates unlimited liability for its partners, which is not recommended for any international investor.

3) Registering the Company at the competent Brazilian Registry of Commerce

After deciding the type of company and formulating the Articles of Association, it is necessary to register it at the Registry of Commerce of the Brazilian state where the company will have its headquarters. The preparation of all documents – mainly of the international partners – has to be well executed to prevent the process of registering being delayed many weeks. In the most important states of Brazil the registration of a company at the Registry of Commerce takes from 1 to 6 weeks, if all the documents are correctly presented.

4) Registering the Company at the fiscal authorities

Brazil has a three tier political system: the Federal Union, the states and the local cities/counties. Every company needs to obtain a federal fiscal number (CNPJ), which is granted by the Ministry of Finance at the federal level. Depending on its activities, the company might also need to be registered at the state and/or at the local (city) fiscal autorithies. This is necessary because the Brazilian Tax System is very complex and the company will need to pay taxes to the federal, state and/or local Revenue. On the other hand, the Brazilian public administration is moving fast towards a digital world and many obligations are fulfilled online. In this sense, the directors of a company will be required to obtain a digital certificate such that fiscal obligations before the authorities can be accomplished.

5) Obtaining the local registration and operational license

Every company in Brazil needs to be registered at the local public administration (city/county), obtain an operational license and, in some cases, obtain fire department approval. Initiating business before getting these licenses may lead to the application of fines or the closure of the office.

6) Other required licenses according to the developed activities

Depending on the developed activities, mainly in case of import/export or industrial activites, it might be necessary to obtain special registrations, licenses or environmental permits from the Brazilian authorities. Also, by the production, import/export or trade of particular products (for example medicine, medical and cosmetic products) special permissions and registrations might be needed. It is recommended to be well informed about the exact requirements, as some of the processes to obtain these licenses/permits/authorizations can take a long time. Below is a list of examples of Brazilian authorities/systems that issue some of the necessary licenses/ permissions/registrations, among others:

-

SISCOMEX (Integrated System of Foreign Commerce): qualification of import/export agents and registration of export/import activities;

-

ANVISA (Brazilian National Health Surveillance Agency): registration of medicine, medical, orthodontic and cosmetic products, among others that can offer health risks;

-

INMETRO (National Institute of Metrology, Quality and Technology): registration of conformation of products;

-

IBAMA (Brazilian Institute of the Environment and Renewable Natural Resources): federal environmental permissions.

Finally, depending on the area of influence of the developed activities, state and local permissions shall be necessary.

7) Registering the corporate capital at the Brazilian Central Bank

Once the company is registered at the Registry of Commerce, the corporate capital shall be transferred from the international investor (partners/shareholders) to the bank account of the Brazilian company. This wire transfer has to be registered at the Brazilian Central Bank in its SISBACEN (RDE-IED) electronic System, where the information of international investor is maintained. The payment of corporate capital by import of intangible assets is possible, but subject to strength regulation, and is normally avoided. Only the correct registration of the investment made by the international investor at SISBACEN will allow the future transfer back of capital, profits or dividends abroad.

Other financial operations between foreign investors and the Brazilian company also have to be registered at the SISBACEN (RDE-ROF), such as loans, rents, royalties, foreign trade financing instruments, among others.

8) Further information

Before incorporating your company in Brazil, we recommend you read our guide about other important themes, for example:

– How to register and protect a trademark in Brazil;

– How to register and protect a patent in Brazil;